How to assign items to Tax categories? Item Category List associates the tax Category to an inventory item in an Organization. The user can add many items to a list and select relevant tax categories for them. There can be many such item category lists defined and associated with the supplier sites.

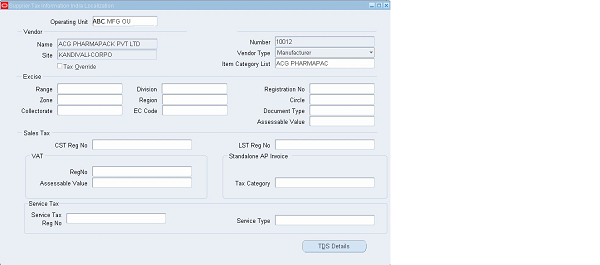

If the item category is attached to the Additional supplier information, the item category will get defaulted whenever a transaction is done with the supplier.

Navigation

How to Setup Oracle Apps Purchasing in item categories

India Local Purchasing→India Localization → Setup → Tax Setup → Item Categories

Defining Item Categories

1. Select the Organization for which you want to set up the Item Categories

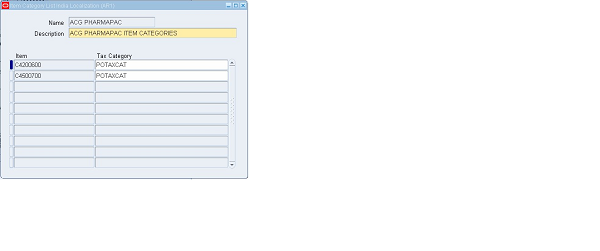

2. Navigate to the Item Category India Localization window as shown below.

3. The meaning for the fields are explained below

• Name – The user has to specify a unique Item Category List name.

• Description – Enter a description for the Item category list.

• Item – Select the items from the LOV.

• Tax Category – Select the relevant Tax Category from the LOV.

Note: By assigning this tax category list to a supplier site in the Supplier Tax information India Localization window, the tax lines for a particular supplier site, for a particular item will get defaulted according to the precedence set in the tax category. The user should use a unique item category list name and meaningful description.

Other Related Articles

DEFINE BUYERS

DEFINE APPROVAL GROUP

APPROVAL ASSIGNMENT

APPROVAL HIERARCHY

NUMBERING SEQUENCE ASSIGNMENT

REQUISITION TEMPLATE

ITEM CATEGORIES

OPEN AND CLOSE PURCHASING PERIODS