TDS Payment Invoice? As per existing rules under the Indian Income Tax Act, we are required to deduct tax at source from amounts payable to suppliers for services rendered under Contract, Professional Services, Rent, Interest, commission, etc covered under different TDS sections.

Before we can enter invoices against suppliers with TDS taxes

• All tax codes as applicable under existing rules should have been defined in the application.

• Threshold setups for each vendor type and TDS section combination should have been done.

• Supplier additional information for all suppliers should have been updated with relevant TDS details as applicable by specifying PAN and TAN numbers.

Follow the steps to create TDS Payment Invoice with TDS tax codes

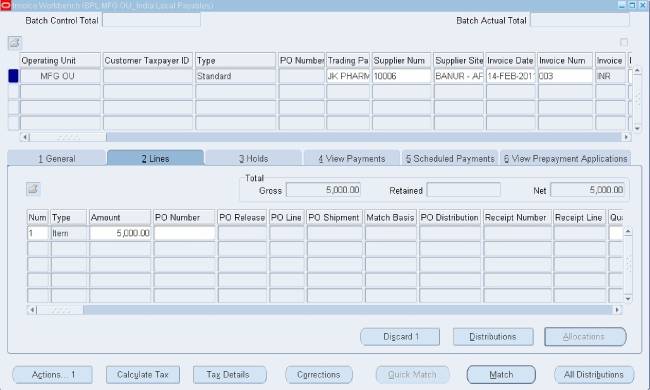

1. Enter the invoice with all required details in the invoice headers.

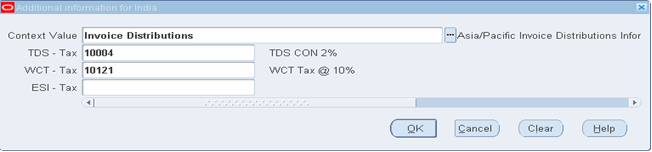

2. In invoice line distributions after entering the line details, select India distribution global flexfield to assign TDS tax codes.

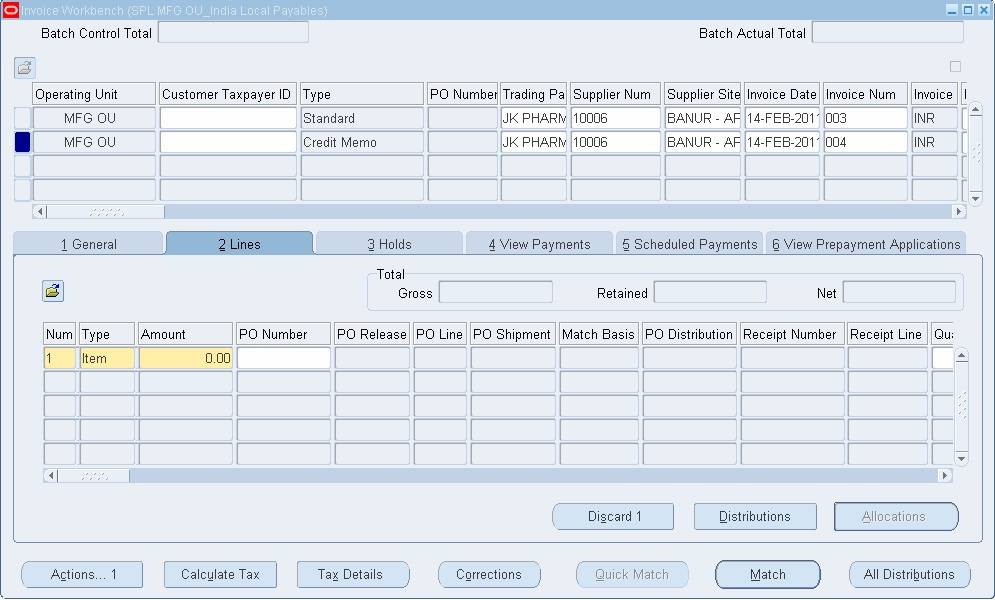

3. When you validate a standard invoice or prepayment invoice, the system would generate concurrent requests for generating a credit memo on a vendor for the tax to be deducted and a standard invoice on tax authority for the tax to be paid to the Income Tax dept.

4. We can query the standard invoice and credit memo created by payables for the TDS payment amount in the Invoice workbench by entering the invoice number with % as a suffix. The system uses the invoice number and suffixes it with TDS-(Invoice Type)-(serial number) to insert the invoice number for the credit memo and a standard invoice generated as above.

5. Various scenarios and system behavior is listed below

| Scenario | Behavior |

| Invoice created but does not reach single/cumulative threshold limits | No TDS invoice will be generated |

| Invoice created that reaches the single threshold limit | TDS will be deducted and an invoice generated based on the tax code applicable for a single invoice threshold |

| Invoice created that reaches the cumulative threshold limit | TDS will be deducted based on the tax code applicable for the cumulative threshold limit. |

| Adjustment invoices will be generated based on tax already deducted. | |

| Invoice distribution has different tax codes assigned to different distribution lines. | TDS will be deducted and separate TDS invoices will be generated for each line. |

| The invoice distribution line is assigned with taxes attached for TDS, WCT and ESI | The system will generate 3 TDS invoices on validation of standard invoice |

| Standard invoice having TDS, WCT, and ESI taxes is canceled | TDS, WCT and ESI invoices will be canceled |

| The standard invoice with both negative and positive distribution lines | TDS invoices are generated for both lines |

| Creation and validation of prepayment invoice | The system will generate TDS invoices with the current threshold limit |

| Application of prepayment invoice having TDS tax codes to standard invoice with TDS taxes | The system will generate TDS invoices for tax codes assigned to standard invoices and RTN invoices for reversal of TDS already deducted on prepayment invoice. |

| Un-apply prepayment invoice | The system will generate reverse invoices that were generated when prepayment was applied. |