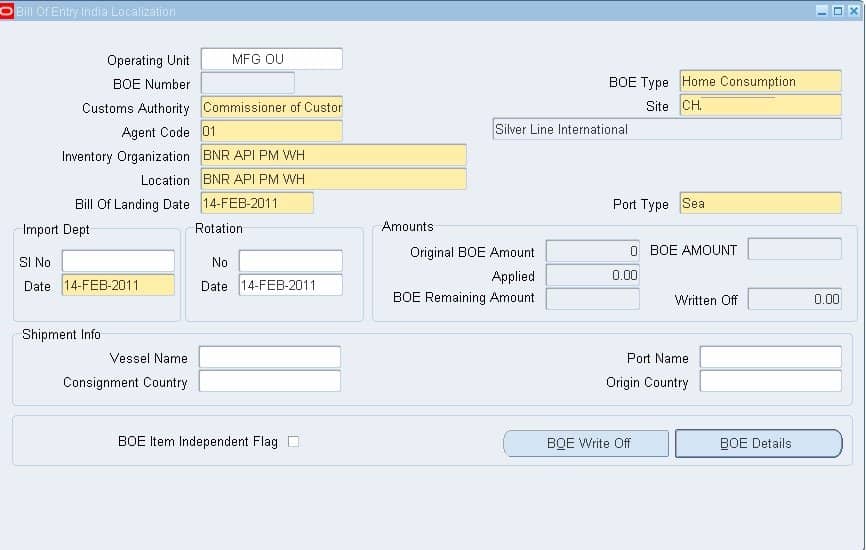

BOE Invoices are created for payment of customs duty against import purchases.

India Local Payables→ Invoice Entry→ BOE Invoices

1. Select BOE Type as ‘Home Consumption’ (available values are Bonded, Warehousing, and Home Consumption)

2. Select the Customs Authority supplier and supplier site to which customs duty is to be paid.

3. Select Agent Code (clearing and forwarding agent)

4. Select the inventory organization and location in which the purchase receipt would be taken

5. Select the bill of lading date

6. Select port type (Air, Sea, Land)

7. Enter Import serial number (optional) and BOE Date, Rotation number & Date

8. BOE Amount (defaults from BOE details)

9. Enter Vessel name, consignment country, port name, and origin

10. Choose BOE Details

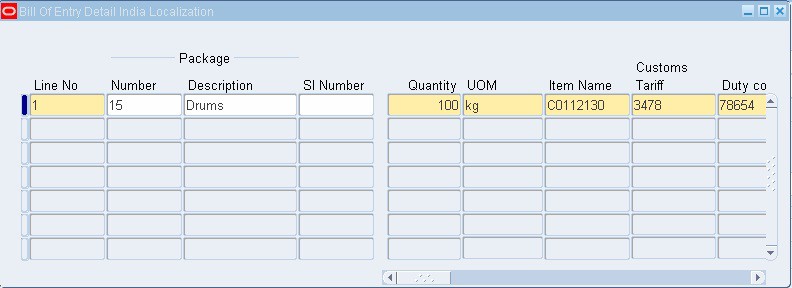

In BOE Details

1. Specify the number of packages (Optional)

2. Description of packages (Optional)

3. Serial number of item packed (optional)

4. Enter Quantity, UOM, and select Item name (mandatory)

5. Enter customs tariff and duty code (mandatory)

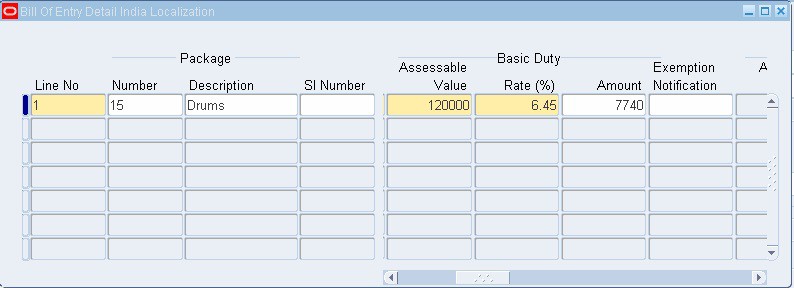

6. Enter the Assessable value of goods on which customs duty is paid (mandatory)

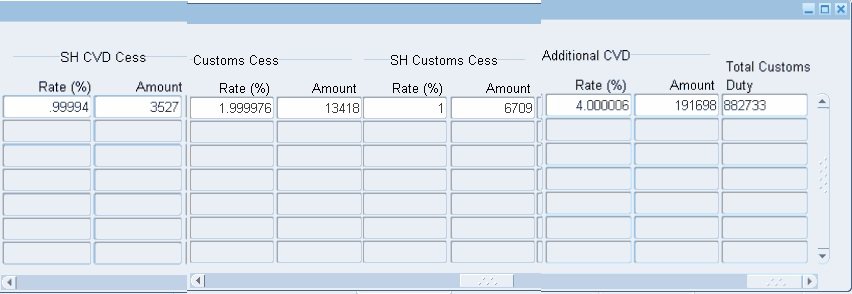

7. Enter basic customs duty rate, Additional duty rate, CVD cess rate, Customs duty Cess Rate, Special Additional Duty rate (mandatory)

8. System calculates basic customs duty, additional duty, CVD cess, customs duty cess, and special additional duty amounts based on rates specified and displays total duty

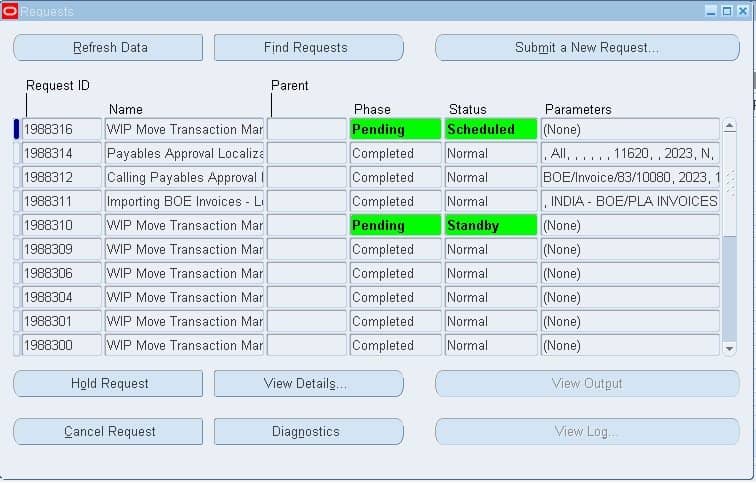

On saving the BOE Invoice transaction, the system submits the following concurrent requests to generate a standard invoice on customs authority which can be validated, accounted and paid.

a. Importing BOE Invoices – Localization

b. Calling payables approval Localization c. Payables approval localization

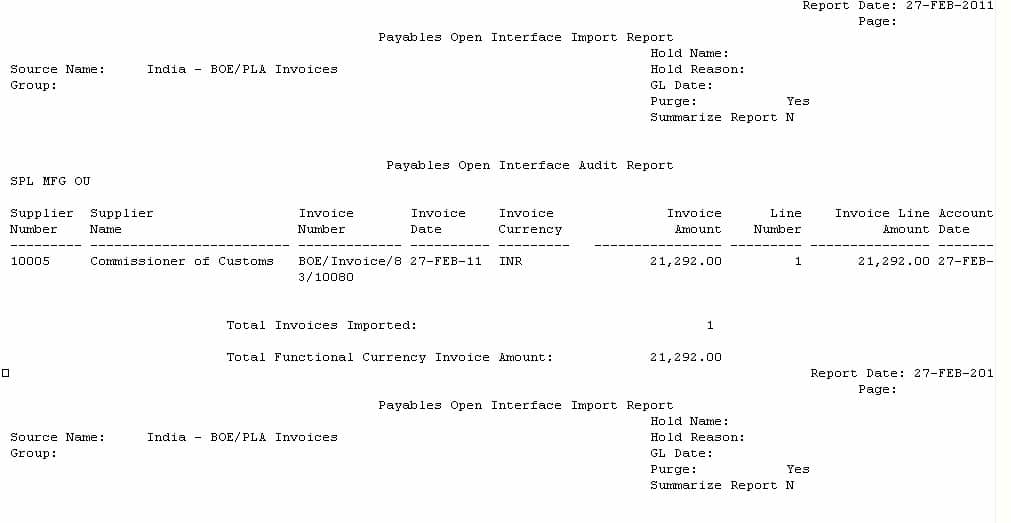

View Output for Program “Importing BOE Invoices – Localization” and copy the Invoice number.

Invoice Number: BOE/Invoice/83/10080

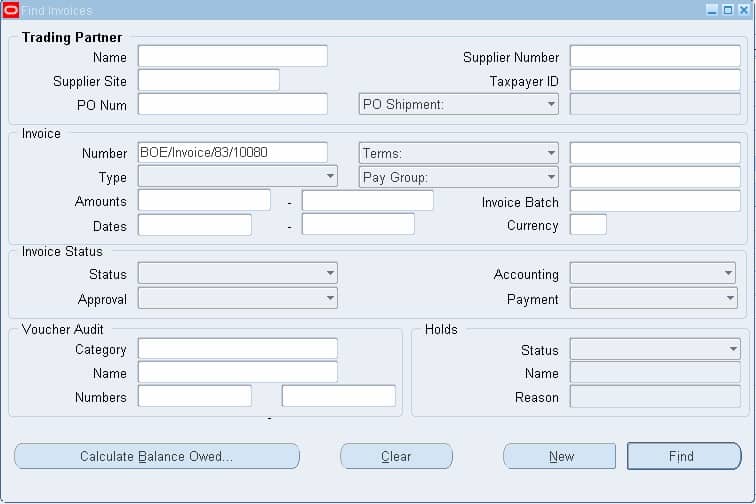

Navigate to AP Invoice Window, Click on View Find or use the torch button and find the Invoice.

Click on the Find tab, validate the invoice and make the payment.