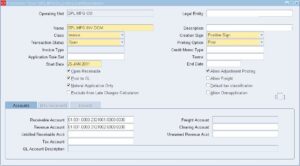

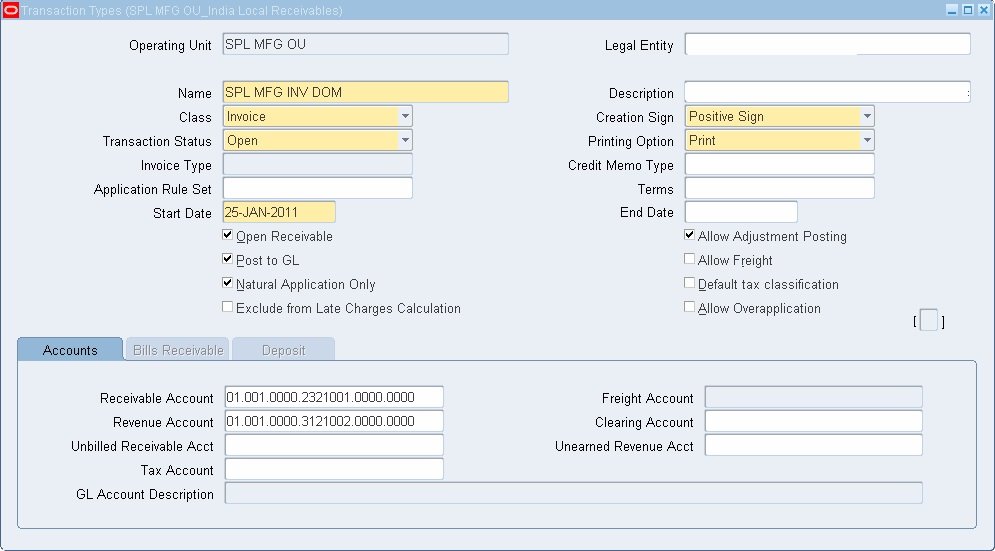

Navigation: Oracle Receivables→ Setup→Transactions→Transaction Types

Transaction types in Receivable determine the type of transaction (transaction classification) Invoice class, default payment terms, creation sign, effective dates, updates to customer balance, posting to GL, method of the application allowed, and accounting information. It is mandatory to have at least one transaction type defined for each invoice class in receivables for creating Invoices, debit memos, and credit memos. For SPL, transaction types include – Domestic –VAT (Within State), Domestic – CST (Out Of State), Export Sales, High seas Sales, Sales against Form H, Scrap Sales, By-Product Sales, Consignment Sales, Consignment Transfer, Bills Receivable –Exports/Domestic, Debit Memos and Credit Memos.

Name and Description:

Determines the name and description of the transaction type. Enter name and description to represent relevant revenue account to which the transaction is to be accounted.

Class:

Determines associated class for the transaction type. Valid values are Invoice, Credit Memo, Debit Memo, Deposit, Guarantee, chargeback, and Bills Receivable. Select the category as applicable for the transaction type. (Ex. Select Invoice class for Domestic – CST) We choose invoice class for transaction types used for raising invoices on customers. The ‘Debit Memo’ classis selected for transaction types used for raising debit notes on customers for additional charges’ credit memo’ class is used for defining transaction types to record returns from customers and to credit customer accounts for price and other adjustments. ‘Bills Receivable’ transaction type is used for expressing transaction type to create bills receivable transaction.

Creation Sign:

Determines whether the transaction can be entered with a positive value, negative value, or both. For Invoice, debit memo, and Bills Receivable class of transaction types, the creation sign is to be selected as ‘Positive’. For the credit memo class of transaction, types choose the creation sign as ‘Negative’

Transaction status and Printing Option:

Choose transaction status as ‘Open’ and printing option as ‘Print’ for all transaction types.

Credit Memo Type:

For transaction types defined with a class other than ‘credit memo’ select credit memo transaction type which should be used by the application for crediting customers.

Payment Terms:

The select default payment term for the transaction type. This payment term will be overridden by the payment term defined at the customer level. In other words, if we do not define payment terms at the customer and customer site level, the system would use this payment term for the transaction.

Open Receivables:

Determines whether transactions entered with this transaction type update customer balance. Enable this check box for all transaction types. For Surya, the Consignment sales transaction type is not enabled for open receivables as no payment is expected to be received from customers against such sales. (All payments from the consignment agent would be applied and adjusted against the invoice raised with the consignment transfer transaction type.). The transactions entered with consignment sales transaction type will not be visible as outstanding in Receivable aging reports. Transaction type defined for raising ‘Proforma invoice’ by the marketing department is also not enabled for open receivables.

Post to GL:

Determines whether transactions entered with this transaction type are posted to General Ledger. Enable this check box for all transaction types.

Natural Application or Allow over application:

Determines the type of application permitted for the transaction. The natural application allows the application to the transaction, so as to affect the transaction balance to Zero. Over-application allows us to over-apply to transaction, to affect transaction balance to reverse sign. Choose ‘Natural Application’ for all transactions.

Allow Freight & Default Tax Classification:

Both check boxes are not applicable for this organization and should not be enabled.

Exclude from late charges calculation:

Enable this check box if you do not want to consider any transaction type for late charge calculation.

Revenue Account:

Auto Accounting rules for Surya are defined to pick a revenue account segment for the transaction from the Transaction type. Define revenue account for the transaction type as applicable. All other account definitions are not relevant and necessary to be defined in Transaction type for this organization.