How to define TDS THRESHOLDS Limit for Vendor in accounts payable?

TDS Thresholds are used to specify monetary amount limitations and the taxes that apply to each of these limits. TDS threshold limits are set for section type (TDS Section) and vendor type combination (Vendor Type Combination).

Single and Cumulative Thresholds can be defined in Payable.

• If the threshold amount limit is set to ‘Single,’ TDS will be deducted only when the invoice amount exceeds the threshold amount. TDS will not be calculated on any invoices that are less than the threshold amount.

• When we set a ‘Cumulative’ threshold limit, payable aggregates all bills for the fiscal year, and TDS is deducted for all invoices once the limit is achieved. TDS will be calculated on all previous invoices that were overlooked for TDS calculation if the threshold limit is met by an invoice.

With monetary restrictions, we can define both single and cumulative thresholds. The single threshold restriction will apply until the invoice total hits the cumulative threshold limit, after which it will be ignored.

Threshold Set

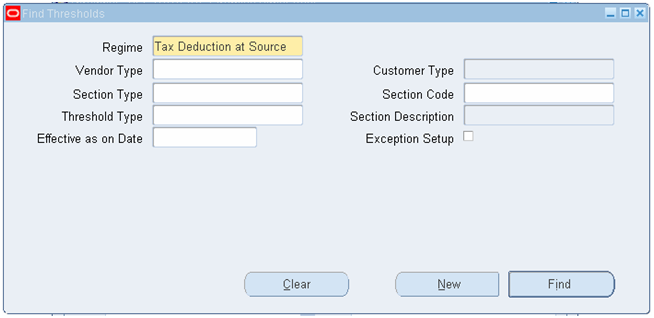

In ‘Find Thresholds’ window,

1. Regime: Select ‘Tax Deduction at Source’

2. Choose ‘New’ button to define new threshold setup or Choose ‘Find’ to view and update existing threshold setup

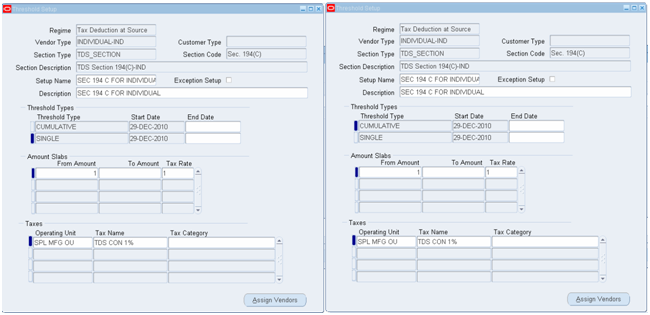

Single Threshold Cumulative Threshold

Note : Only one threshold can be defined for each Vendor type, Section type, and Section code combination. Any changes to amount slabs and tax rates must be established in the same configuration, with an end date for previous definitions.

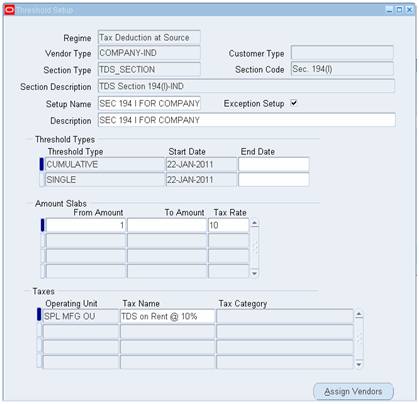

In threshold setup window

1. Regime: Select ‘Tax Deduction at Source’

2. Vendor Type: Select Vendor type for which you are defining the threshold setup – COMPANY-IND, INDIVIDUAL-IND or OTHER PERSONS-IND

3. Section Type: Select ‘TDS_SECTION

4. Section Code & Section Description: Select TDS section for which the setup is defined 194 (A), 194 (C), 194 (H), 194 (I) and 194(J). Section description defaults based on section selected

5. Setup Name and Description: Enter name for the setup so as to indicate both vendor type and section type for which it is defined.

6. Threshold Type & Start Date: We have option to select ‘Single’ or ‘Cumulative’ threshold types based on requirement. Select ‘Single’ threshold type to define amount slabs that are applicable for each single invoice. Select ‘Cumulative’ to define amount slabs that are applicable for cumulative total value of invoices raised during the TDS accounting year. Specify Start date for the type selected.

7. Amount Slabs & Tax rate: Amount slabs are to be defined separately for each threshold type selected above by specifying amount range and tax rate. The ‘from’ amount we enter determines the limit from which the system starts generating tax invoice using the tax code. For example: If we specify ‘0’ as ‘from’ amount, payable calculates tax for all invoices starting from first invoice with amount greater than 0. If we specify 20000, payable calculates tax only when invoice amount exceeds INR 20000. The Threshold type selected above determines whether the limit specified is for single invoice amount or for cumulative amount of all invoices. We specify ‘To’ amount to restrict the applicability of tax rate up to the amount we specify. Beyond that amount, the specified tax rate is not applicable. If a different tax rate is applicable for amount beyond that we can have a second line in amount slabs to define the ‘from’ and ‘to’ range of amounts.

8. Taxes: Select operating unit and tax code relevant to tax rate assigned to amount slabs

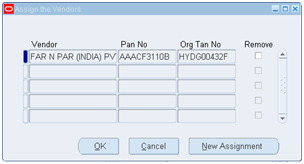

9. For Concessional rate of taxes, we can enable exception setup check box and assign vendor to whom this setup is applicable.