How to define Taxes in Accounts Payable?

Setup→Tax Setup→ Taxes

• Tax handling functionality under India localizations satisfies all tax requirements relating to purchasing and sales. They include central excise, central sales tax, value added tax, customs duty, service tax, tax deduction at source, other taxes like freight, insurance, discounts etc. All taxes under India localization are calculated based on Tax codes defined and applied to transactions.

• Tax categories help us to group related tax codes with set precedence for tax-on-tax types to default in transactions when user choose to apply them.

• Item category lists allow us to assign tax categories to items. Item categories can in turn be assigned to supplier and customer to default taxes in transactions based on inventory item.

• We can define taxes with percentage rate, Unit rate or adhoc type. Adhoc type can be used where only appropriate value can be assigned while creating transaction.

• Taxes with concessional rate can be defined by along with concessional form or certificate to be received to avail the concessional rate by specifying original tax percentage to be paid in lieu of non-submission.

• We can assign and calculate taxes in multiple currencies.

• We can define tax recoverable information to determine whether it is included in item cost for inventory valuation.

• We can define third party taxes to generate separate invoices on third party vendors.

• Tax codes once saved cannot be updated. We can only end date a tax code to disable it.

• All tax definitions are specific to operating unit. We can select any inventory organization within the operating unit while defining tax codes in taxes in accounts payable.

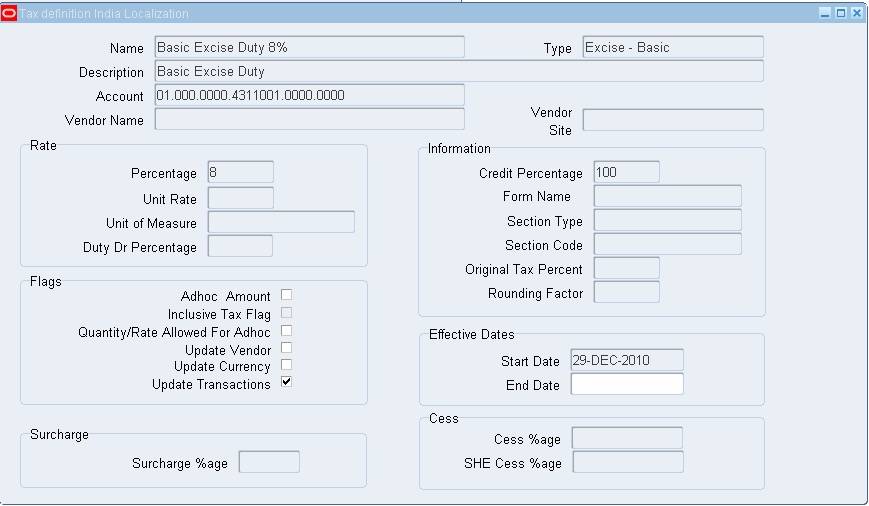

Name: Enter a short tax name/tax code in this field which should convey both name and usage of tax.

Type: Select type of tax from list of values. Tax codes should be associated with appropriate tax types only in tune with requirement. Type determines the treatment of tax at transaction level. It also determines the procedure that needs to be initiated to calculate, and update tax records.

| Tax Type | Tax Type | |

| Excise- Basic | Central Sales Tax | |

| Excise – Additional | Service Tax | |

| Excise – Special | Service Tax – Education Cess | |

| Excise – Education Cess | Service Tax – SH Education Cess | |

| Excise – SH Education Cess | Tax Deduction at Source | |

| Customs Duty | Value Added Tax | |

| Customs – Education Cess | Any Other Tax | |

| Customs – SH Education Cess | Freight | |

| Additional CVD | ||

| CVD – Education Cess | ||

| CVD – SH Education Cess |

Description: Enter meaningful description for the tax code defined

Account: Enter relevant account code combination for the tax code. In order to cash cycle, the account we specify for the tax code will be used for the tax transactions. In procure to pay cycle, the account we specify for the tax code will be used only for recoverable taxes with tax types other than Excise, VAT and Service tax. For example: When we define tax code for CST refund with 100% Credit then during delivery of PO receipt, sales tax will not be considered for the item cost and the entire amount will be considered as recoverable tax and will hit this account.

Vendor Name & Vendor Site: We can specify vendor name & site for all tax codes with tax type other than Excise and Customs. For ‘Tax deduction at source’ tax type, we can select vendor with

‘TDS Authorities’ Vendor type only. We can select other vendors for other tax type. The vendor name defaults in Purchase order tax lines and it can be updated with if ‘Vendor Update’ flag is enabled for the tax code. For example, for ‘Freight’ or ‘Any other tax’ type of tax in PO tax lines, we can update and assign a vendor different from vendor for the PO. On receipt of goods against purchase order, system generates invoice on the assigned vendor and also updates item cost for the freight or other charges.

Rate: You can specify percentage or Unit rate at which the tax has to be applied for the transaction using this tax code. We can enable ‘Adhoc’ flag to enter tax amount at transaction level.

Credit Percentage: This field determines the recoverable and non-recoverable percentage of tax for all input taxes.

Form Name: This field is relevant for TDS and ‘Sales Tax’ tax type to specify Form Name like ‘C Form, Form 17 etc.

TDS Section No: This field is relevant for TDS tax types to specify TDS section under which this tax code is defined. This information is used for generating TDS reports separately for each TDS Section.

Original tax percent: We enter original tax percent when tax code is defined with concessional tax rate

Rounding factor: Tax will be rounded to nearest rupee if left blank.

Update Vendor: When we enable this flag, it allows us to update default vendor name in PO tax lines.

Update Currency: When we enable this flag, it allows us to update currency in PO Tax lines. This is required to be enabled for customs duty tax types since taxes are to be defined in INR when PO on vendor is raised in foreign currency.

Cess%: Specify percentage of education cess for TDS tax type

SHE Cess%: Specify percentage of Secondary education Cess for TDS tax type.

Start Date and End Date: Start date cannot be before than the current date. End date should be greater than the start date or left blank.