Bills payable help us to control the timing of our payments and control of our cash flow. It is used to instruct bankers to disburse funds to the supplier’s bank on a specific date known as the maturity date. We can enter bills payable transactions in payables in the window of the payment against invoices associated with the payment method that is enabled for the issue of bills payable. At SPL, for LCs negotiated with usance credit, the Bills Payable feature would be used for recording LC liability immediately after the shipment of goods by the importer and on submission of relevant documents to the bank as per LC terms. On the maturity date when the bank issues the payment to the supplier the LC liability is cleared in payables

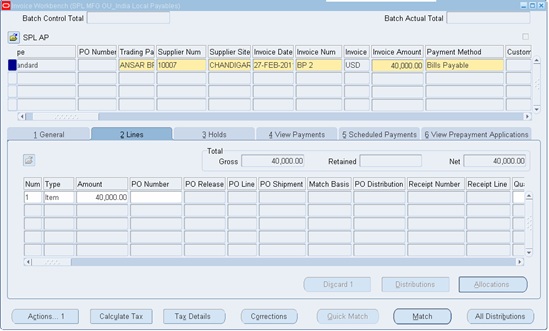

Invoice Creation with Bills Payable payment method

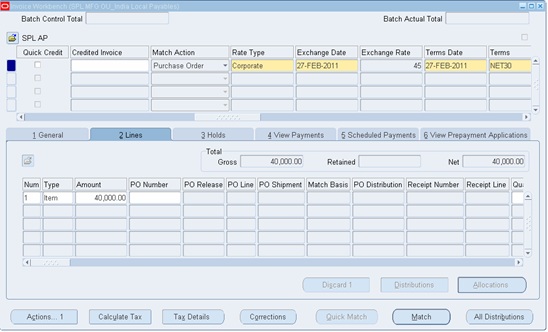

When the invoice is matched against the purchase order receipt wherein PO is issued to the supplier with LC payment terms, the payment method for the invoice should be updated to Bills payable

When the invoice is in foreign currency, the Invoice will be accounted with the BOE date as the exchange rate date using the ‘Corporate’ exchange rate type

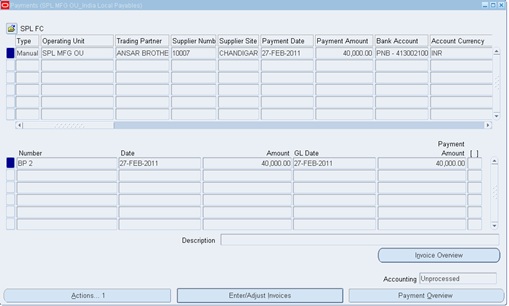

To create single payment with Bills Payable payment method

1. Select ‘Manual’ payment Type, Supplier, bank account, and Invoice with Bills Payable payment method.

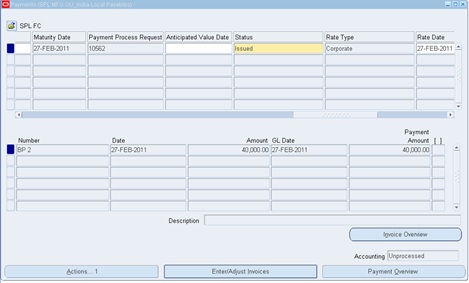

2. Record payment with the exchange rate same as in the Invoice by specifying the maturity date. The current status of the payment is ‘Issued’.

3. In the Maturity Rate type field, select the ‘User’ rate type and enter the exchange rate. This allows us to modify the exchange rate as applicable at the time of payment by the bank on the maturity date. (banker’s rate)

4. On accounting the payment payables will generate the following journal to record LC Liability

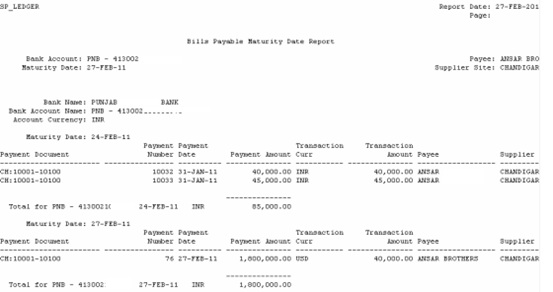

5. Cash Requirement for LC Liability by maturity date can be known by submitting ‘Bills

Payable Maturity date Report’

Submit the Request. View the request status and verify the Report Output.

6. On the Maturity date, when the bank releases payment to the supplier, obtain the exchange rate as per the bank and update the payment in the Maturity rate field and save the record

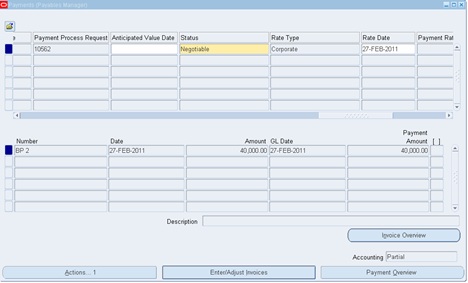

7. Submit ‘Update Matured Bills Payable Status’ for the maturity date by selecting vendor, vendor site, and bank

8. Payable updates the Payment with the status of ‘Negotiable’ And Accounting status as ‘Partial’.

The maturity rate field is greyed out with the new exchange rate updated.

9. On accounting payment, the System generates Entry with exchange gain\loss entry with revised exchange rate