Concept

Enter a credit or debit memo to record a credit for goods or services purchased. Credit/ debit memos are netted with basic invoices at payment time.

- Credit Memo. Negative amount invoice created by a supplier and sent to you to notify you of credit.

- Debit Memo. Negative amount invoice created by you and sent to a supplier to notify the supplier of a credit you are recording. Usually sent with a note explaining the debit memo.

Matching

When you enter a credit/debit memo, you can match it to existing invoice(s), purchase orders, or receipts to have Payables automatically copy the accounting information and create invoice distributions for the credit/debit memo. You can match it to an invoice even if it is paid and posted. You can match the credit memo to multiple invoices, and at different levels of detail. Your available choices depend on whether the originating invoice was matched to the purchase order receipt or not.

- Match to an invoice. Payable prorates your credit amount based on the invoice distribution amounts of the original invoice. Payable automatically creates invoice distributions for the credit/debit memo based on the distributions of the original invoice.

- Match to specific invoice distributions. You can allocate the credit amount to specific invoice distributions of the original invoice. Payable automatically creates invoice distributions for the credit/debit memo based on the original invoice distribution that you select. For example, you order three chairs for three different departments and return one. You can match a credit/debit invoice to the original distribution for that department to ensure that the credit matches the charge.

- Match to a Receipt. Match credit and debit memos to receipts when you return goods to a supplier after you enter an invoice for the goods.

- Automatic Debit Memos. If you enable the supplier site option, Create Debit Memo for RTS Transaction, then when you enter an RTS (Return to Supplier) transaction in Purchasing, the system automatically creates an unapproved Debit Memo in Payables that is matched to the receipt.

- Record a Price Correction. Use a price correction when a supplier sends an invoice for a change in unit price for an invoice you have already matched to a purchase order or receipt. You can record a price correction by selecting Price Correction in the Find window when you match a credit/debit memo to a purchase order shipment, purchase order matched invoice distribution, or receipt. When you record a price correction for a credit/debit memo, you are recording a price decrease from the original invoice. You must specify the number of the original invoice in the Find window.

- Payables update the invoiced unit price of previously matched purchase order shipment or distributions without adjusting the quantity billed so you can track price variances; Payables also updates the amount billed on the initially matched purchase order distributions.

Procedure

Creating credit/debit memo:

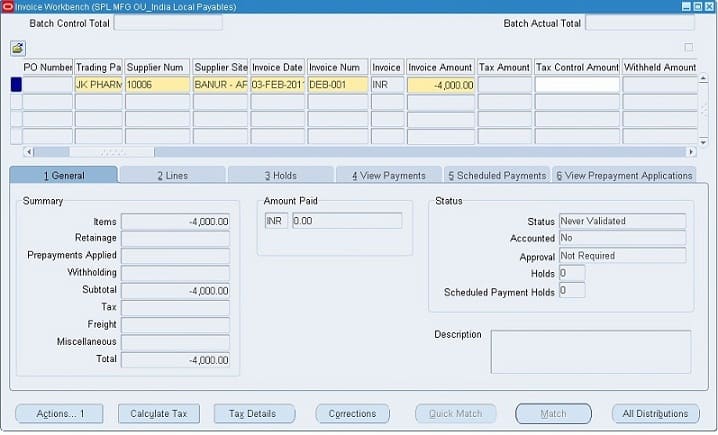

In the Invoices, window enter either the Credit Memo or Debit Memo Invoice Type. Enter a negative invoice amount and all basic invoice information. Enter Payment Terms as appropriate.

Enter distributions. You can enter them or enter them automatically in one of the following ways:

- Enter a skeleton Distribution Set.

- Match to the original invoice you entered.

- Match to a purchase order or receipt.

Matching

To match a credit /debit memo to an invoice or invoice distribution:

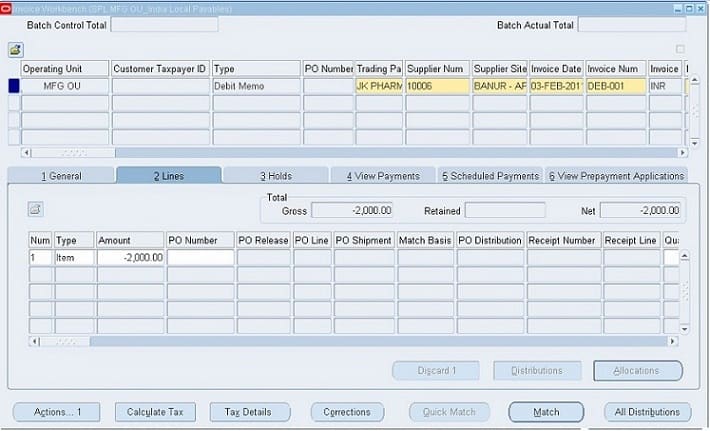

1. In the Invoices window, enter a Credit Memo or Debit Memo type invoice. Enter a negative invoice amount and all basic invoice information but do not manually enter the distributions.

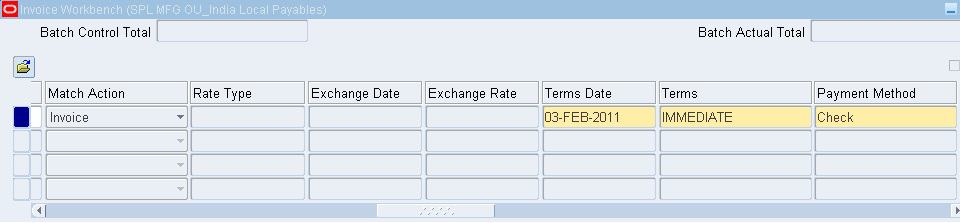

2. Select match action as ‘Invoice’ from the poplist and Choose ‘Corrections’

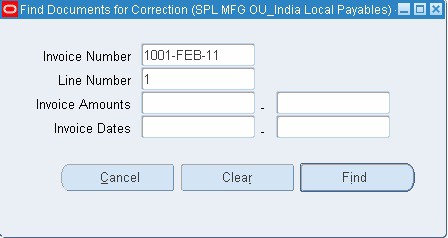

3. The find documents for correction window pops up. Select the invoice against which the debit memo is to be matched. (The invoice is available in the list of values only when it is not matched against any purchase order or receipt.)

4. Choose Find.

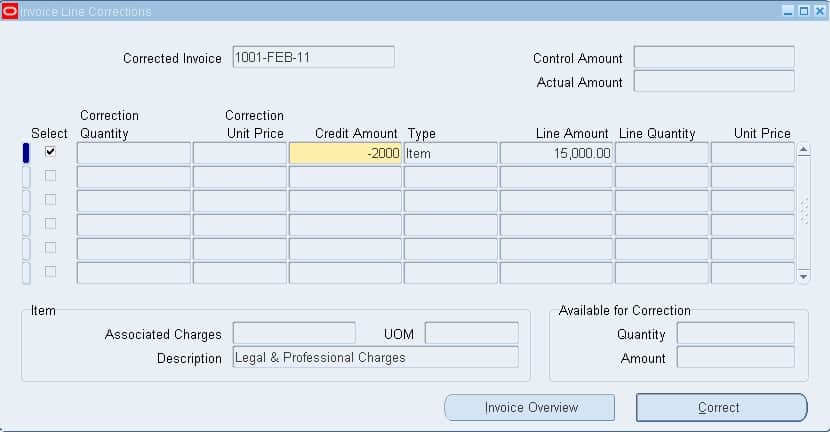

5. Payable navigates to the Invoice Line Corrections window. To see more information about the invoice select the invoice overview button. Select the invoice line by enabling the select check box and enter the credit amount and choose correctly. System process invoice correction and populates the distribution line for the debit memo based on invoice matched.

Automatic Debit Memo

If you enable the supplier site option, Create Debit Memo for RTS Transaction, then when you enter an RTS (Return to Supplier) transaction in Purchasing, the system automatically creates an unapproved Debit Memo in Payables that is matched to the receipt.

Clearing a Credit

You can clear a credit or debit memo you have entered and have been unable to include in a payment. For example, a supplier sends you cash in lieu of a credit invoice, and you have already entered a debit memo. You can pay the debit memo with a refund.

Alternatively, you can perform the following task to enter a positive amount invoice to balance out the impact of the credit/debit memo.

To clear a credit that will not be used:

1. Enter a Standard type invoice for the positive amount equivalent to the credit/debit memo amount to be written off. For example, if you entered a credit for –INR1000, enter a new invoice for INR1000. Other than the invoice amount and invoice number, enter all of the same basic invoice information

you entered on the credit/debit memo. You can enter a write-off account on the distribution if you do not want the accounts on the credit or debit memo to bear the impact of the unrecovered credit.

2. If you matched the credit/debit memo to a purchase order, match the new invoice to the purchase order to correct the purchase order information.

3. Create a zero amount payment at payment time to net the new invoice with the credit/debit memo and clear both from your Invoice Aging.