Foreign Currency Invoice Concept

When we enter an invoice in a currency other than functional currency, Payables uses an exchange rate to convert the invoice and invoice distributions into functional currency for creating journal entries and posting them to Ledger.

For ABC organization, payable uses ‘Corporate’ exchange rate type and defaults exchange rate for the Invoice from GL Daily Rates table (For ABC, this exchange rate would be defined based on the exchange rate declared by customs authority for the month). Payable allows us to alternatively enter an exchange rate manually for the transaction by selecting the ‘User’ rate type.

If the exchange rate is not defined in the application for the ‘Import’ exchange rate type at the time of invoice creation, we can subsequently define and run the Auto rate program in payables to assign the exchange rate for the transaction. If we try to approve invoices without defining rates and running an auto rate program, payable will place a no-rate hold on the invoice. Such hold can be released only after the rate is defined in the application.

ABC records all import purchases by applying the exchange rate as specified in the Bill of Entry which in turn is based on the exchange rate declared by the customs authority for the month. Purchase Order in ERP is raised on the foreign supplier in foreign currency by using the ‘Corporate’ exchange rate type. On receipt of material against the purchase order, the system derives the exchange rate for the ‘Corporate’ rate type for the receipt date from the daily rates table. Since ABC maintains exchange rates with the ‘Corporate’ rate type based on exchange rates declared by a customs authority, when the Bill of Entry (BOE) and purchase order receipt falls within the same month, there would not be any difference in the valuation of receipt in functional currency.

When we manually match an invoice to a purchase order receipt, Payables by default uses the current date as the exchange rate date to derive the exchange rate for the invoice. It does not consider the exchange rate as applicable for the transaction at the time of Purchase order Receipt. After the invoice match, the user is required to change the exchange rate date to be the same as the BOE date.

If there is a difference between the exchange rate applied to the purchase order receipt and the exchange rate applied to the payable invoice matched with the receipt, Payable records the variance as PO Rate Variance. For ABC, this would occur only when BOE is raised in one period and receipt in inventory is taken in another period.

When supplier invoice is auto-generated by the system through the payment on receipt auto invoice program, it automatically derives the exchange rate as per purchase order receipt.

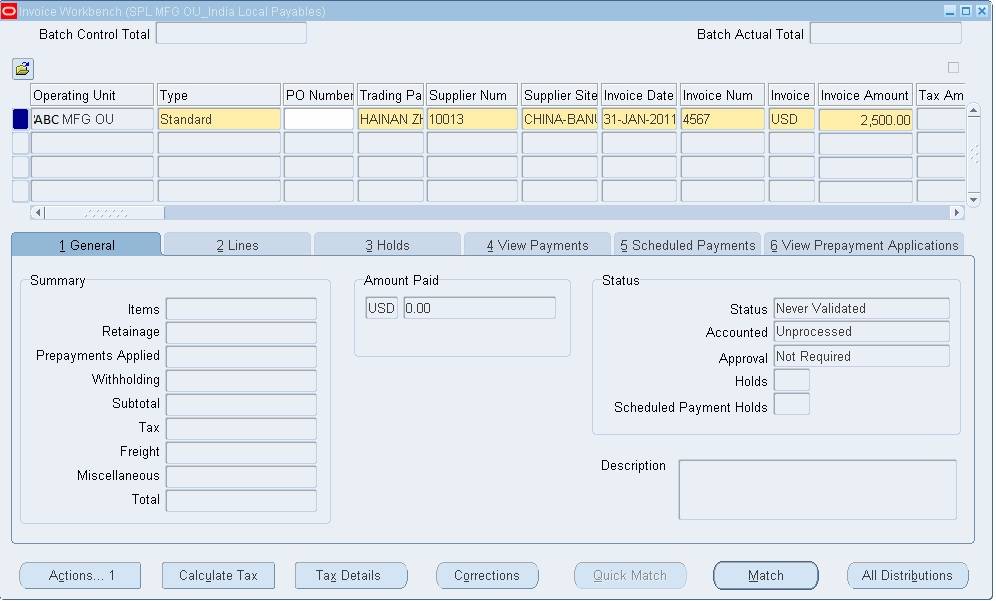

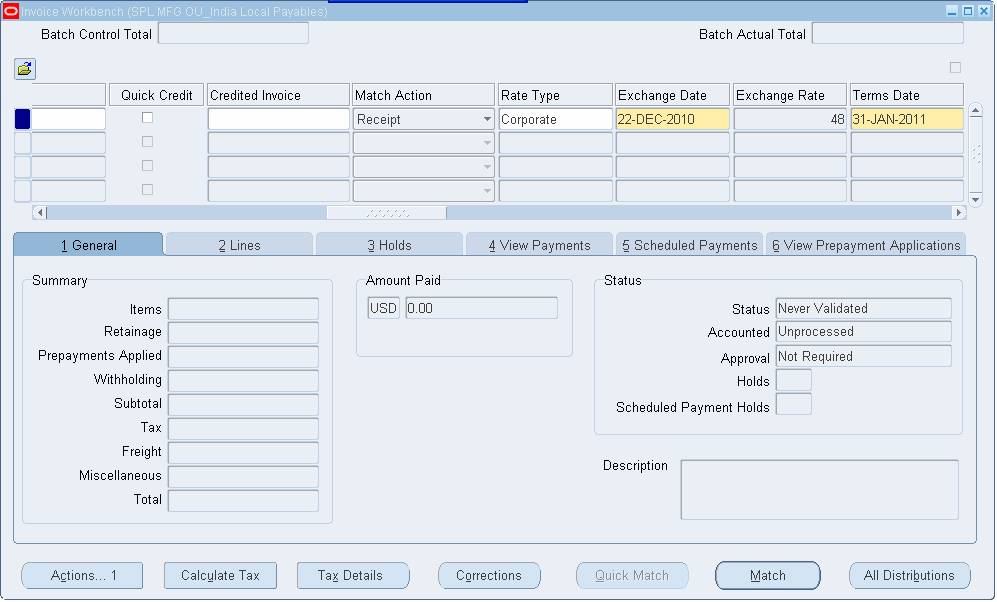

Procedure to enter a foreign currency invoice:

1. In the Invoices window, enter all basic invoice information including the Invoice Currency, and the Invoice Amount expressed in the foreign currency. Before entering distributions or matching the invoice to receipt, proceed with the next step:

2. In the Rate Type field the Import rate type defaults. The exchange rate date defaults based on GL date you enter for the Invoice. Change the exchange rate date to match with BOE date. The exchange rate defaults based on the exchange rate date specified.

3. Match the invoice with the receipt or enter the invoice distributions as required.

4. Complete processing of the invoice and save your work.