Concept

Payment on Receipt enables you to automatically create standard, unapproved invoices for payment of goods based on receipt transactions. Invoices are created using a combination of receipt and purchase order information, eliminating duplicate manual data entry and ensuring accurate and timely data processing. Payment on Receipt is also known as Evaluated Receipt Settlement (ERS) and Self Billing.

You can automatically create invoices with multiple items and distribution lines and include localization tax.

Default information

You define which supplier sites participate in Payment on Receipt and enforce matching rules to ensure the proper payments are made to the suppliers. Payment on Receipt builds invoices with the following information:

• Amount Determined by multiplying the Quantity received by the Purchase Order Item Unit

Price.

• Payment Terms Defaulted from the purchase order payment terms or from the supplier site payment terms, depending on your Oracle Payables setup.

• Tax Based on Tax Codes on each purchase order shipment, or the default tax hierarchy in

Payables.

• Invoice Currency Defaulted from the purchase order Currency.

• Payment Currency Defaulted from the purchase order Currency.

• Invoice Currency Defaulted from the purchase order Currency.

Matching to Purchase Orders or Receipts

When Payment on Receipt runs, it automatically performs invoice matching to the purchase order or receipt, depending on which Invoice Match Option was chosen in the purchase order Shipments window.

If matching invoices to receipts, Payment on Receipt uses the exchange rate information on the receipt. If matching invoices to purchase orders, Payment on Receipt uses the exchange rate information on the purchase order.

Enabling Payment on Receipt for Individual Purchase Orders and Releases

You can enable Payment on Receipt for individual purchase orders and releases, for any purchase order or release type, by using the Pay On the field in the Terms and Conditions window. (The Pay On value on a blanket purchase agreement defaults onto all the releases created against it.)

The Pay On field defaults to Receipt for all documents whose supplier site is set up as a Payment on Receipt site in the Supplier Sites window, meaning that Payment on Receipt creates the invoices. Changing the Pay On field to Null means that Payment on Receipt does not create an invoice for that document, even if the supplier site is a Payment on Receipt site. If the supplier site is not a Payment on Receipt site, the Pay On field is disabled.

Delaying Payment on Receipt Invoice Generation for receipt corrections

You may want to allow time for returns against the receipts before using Payment on Receipt to automatically convert the receipts into invoices. The profile option PO: ERS Aging Period enables you to specify this delay period between the receipt date and the invoice creation date. When you run Payment on Receipt, it processes only those receipts whose dates are past the aging period. Payment on Receipt invoices include the sum of all returns made against a receipt during that aging period. Any return you make after that aging period, would generate a debit memo for the RTV transactions

For example : Your aging period is two days. You receive 100 items on Monday, but on Tuesday discover that two items were missing from the shipment. You enter a correction to adjust the amount received to 98. When run on Wednesday (or later), Payment on Receipt generates an invoice for 98 items.

Controlling Invoice Prefixes

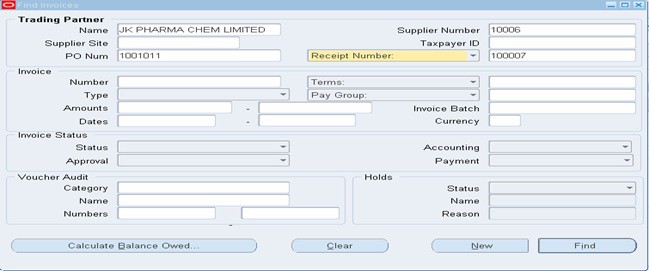

You can find Payment on Receipt invoices by using the Find Invoices window in Oracle Payables to search for any invoice in your system containing the prefix ’ERS–.’ However, you can change this prefix, using the profile option PO: ERS Invoice Number Prefix. For example, shortening this prefix allows extra spaces for longer receipt numbers.

Enforce Match Approval Levels to Ensure Proper Payment

Invoices created automatically are subject to the same match approval levels as standard invoices to ensure proper payment. Two–, three– and four-way match approval levels are enforced by Oracle Payables if you specify two–, three–, or four-way for the supplier site Match Approval Level.

• Two–way match approval is the process of verifying that the purchase order and invoice information match within accepted tolerance levels.

• Three–way match approval is the process of verifying that the purchase order, invoice, and receiving information match within accepted tolerance levels. The three-way match approval level is available with the Receipt required option.

• Four-way match approval is the process of verifying that the purchase order, receipt, inspection, and invoice information matches within accepted tolerance levels. The four-way match approval level is available with the Inspection required purchasing option.

Oracle Payables requires that you approve invoices before you create accounting entries for them or pay them. Approvals can be submitted for selected invoices in the Invoice Workbench or by batch process. All discrepancies and/or adjustments must be handled manually using the appropriate online Purchasing, Receiving, and/or Payables windows.

Creating Scheduled Payments

Payable creates scheduled payments for each invoice based on the payment terms and the invoice terms date. After the invoice has been created, you can use the Scheduled Payments window to modify information such as due dates , and to change payment and discount amounts.

Defining Payment on Receipt Supplier Information

You can enter supplier information in the Suppliers and Supplier Sites windows to identify which of your suppliers are eligible for Payment on Receipt and can have their invoices automatically created using the Pay on Receipt Auto Invoice program. In addition, you can specify an alternate Payment on Receipt pay site if the supplier’s pay site address is different from the purchasing address. For invoices created based on receipt transactions, you can set up invoice consolidation levels for an individual pay site. You also define the default Payment Currency in the Suppliers and Supplier Sites windows.

Submitting Pay on Receipt Auto-Invoice Program

The Pay on Receipt Auto Invoice program automatically creates an invoice batch depending on the options in the Payables Options window. Invoice count and invoice total are calculated automatically.

To run Payment on Receipt:

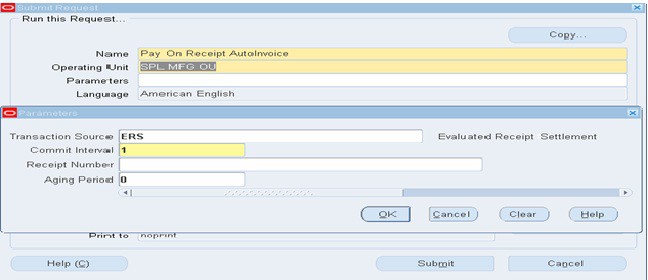

1. Select the Program Pay on Receipt Auto Invoice from the Requests window of Purchasing Responsibility. Choose the Transaction Source ERS

2. Enter a Commit Interval. The Commit Interval is a numeric representation of the number of invoices evaluated before they are committed. For example, if you have a Commit Interval of 10, after 10 invoices have been processed, they are committed. If you then process another 5, and the process fails, only 5 will not be committed.

3. Optionally enter a Receipt Number. If the Receipt Number is null, the program will try to process all the receipts that have not been invoiced successfully. If you enter a Receipt Number, only that receipt will be processed.

4. Optionally enter an Aging Period. The Aging Period defaults from the PO: ERS Aging Period profile option, but you can change it here. For example, an Aging Period of 2 means that Payment on Receipt processes only those receipts that are 2 or more days old.

5. Choose OK and then Submit Request to begin the process.

6. Make sure the Payment on Receipt process and the Payables Open Interface Import process completed successfully. After this process completes, it calls the Payables Open Interface Import process to complete invoice creation.

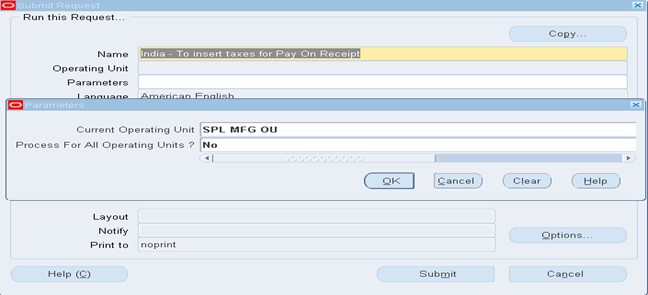

India – To insert Taxes for Pay on Receipt

7. After payable open interface import has successfully imported an un-validated invoice against purchase order receipt, submit ‘India – To Insert Taxes for Pay On Receipt’ concurrent request to insert tax distribution lines for invoice auto-created by system through open interface.

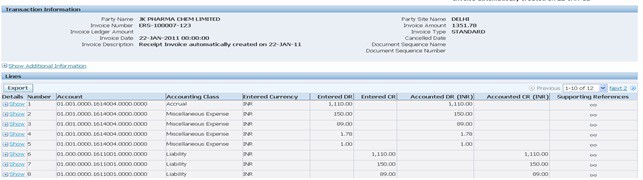

8. Review the invoices in Invoices workbench and process for accounting and payment. No need to match the invoice with PO /Receipt as it is already matched.

On receipt of supplier invoice, enter supplier name, PO number and MRIR number in Find invoices window. Choose Find to query the Receipt matched invoice auto-created in Payables.

Update the following field in the invoice as per supplier Invoice

1. Invoice Date

2. Invoice Number

3. Payment Method (In case of LC payment terms select ‘Bills Payable’ payment method, otherwise select ‘Check’ Payment)

4. Exchange Rate. In case of foreign currency transactions, payable defaults exchange rate type, rate date and rate as per Receipt. In case exchange rate as per Bill of Entry (BOE) is different and needs to be changed for the Invoice, change exchange rate date for the transaction to default from GL daily rate table. And save.

5. GL Date: In case, the default GL date for the transactions is to be changed, we have to perform this change manually in both Invoice header and Invoice lines. When you change GL date in Invoice header it does not automatically change in invoice lines. We have to change it manually. The GL date in invoice lines takes precedence over GL date in Invoice header and is considered as accounting date by create accounting program.

6. Review other information for the invoice and perform validate and create accounting.

PO Rate Variance

In case of Invoice matched against PO Receipt in foreign currency, when exchange rate applied for the invoice differs from receipt exchange rate, payable generates and posts the difference of value in functional currency to PO Rate variance account.