Payment Terms

Payment Terms aid in setting the payment schedule, or when an invoice is required to be paid. A payment term can include numerous lines, each dependent on the percentage due or the amount due. For instance, 60%. The first ten percent of the payment is due in ten days, and the remaining forty percent is due in twenty days. The payment terms provided here are assigned to the supplier/supplier site, and they are then applied to all invoices recorded against the supplier/site, determining the payment schedule for each invoice. The ‘Cash Requirement Report’ is created using payment terms.

Setup→Invoice→Payment Terms

Define Payment Terms

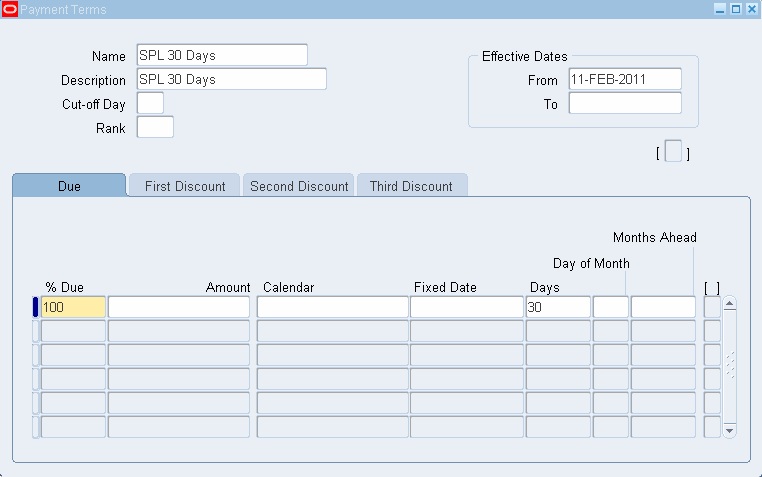

Name & Description: Enter the name for the Payment Term. The name should be unique and precise so as to provide a meaningful description of the usage of term / payment schedule defined. This would help us to select and assign correct payment term for the transaction.

Effective Dates: Specify the start date. The payment term is effective and available for selection in supplier/site, PO or invoice from this date. We can specify an end date to make the payment term invalid after that date.

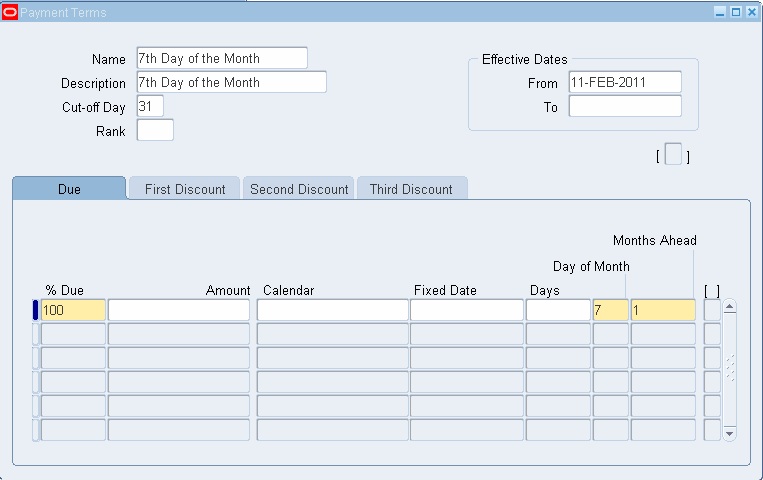

Cut off Day: The cut-off day is used in conjunction with Day of the month & Months Ahead terms type only. Payable compares the invoice terms date to cut-off date we specify.

% Due/ Amount: Specify % due or amount to determine the portion of an invoice due on the scheduled payment date. The total of all scheduled payment lines must equal to 100. For example, specify % due as ‘100’ to consider whole invoice amount as due on the schedule date.

Days/ Day of the month & Months Ahead: Specify number of days in ‘days’ field to determine the due date for payment term line. Specify Day of the month and Months ahead if the payment is required to fall due on a specific day of the month for the transaction entered on or before the cut-off day specified.

For example: The ‘7th day of the month’, payment term can be used for TDS tax authority supplier invoices as we are required to make payment of all invoices raised during the month by 7th of subsequent month. The payment term is defined with cut of day as 31 with 100% due on 7th day of month with Months ahead as 1. All invoices raised between 1st to 31st (cut-off day) will have 7th of subsequent month as due date in payment schedule.