Concept

A “prepayment” is a type of invoice you enter to make an advance payment to a supplier or employee. For example, you need to pay a deposit on a lease or pay an employee an advance for travel expenses. You can later apply the prepayment to one or more invoices or expense reports you receive from the supplier or employee to offset the amount paid to them.

Types of prepayments:

You can enter two types of prepayments: Temporary and Permanent.

- Temporary prepayments can be applied to invoices or expense reports you receive. For example, you use a Temporary prepayment to pay a hotel a catering deposit. When the hotel’s invoice arrives, apply the prepayment to the invoice to reduce the invoice amount you pay.

- Permanent prepayments cannot be applied to invoices. For example, you use a Permanent prepayment to pay a lease deposit for which you do not expect to be invoiced.

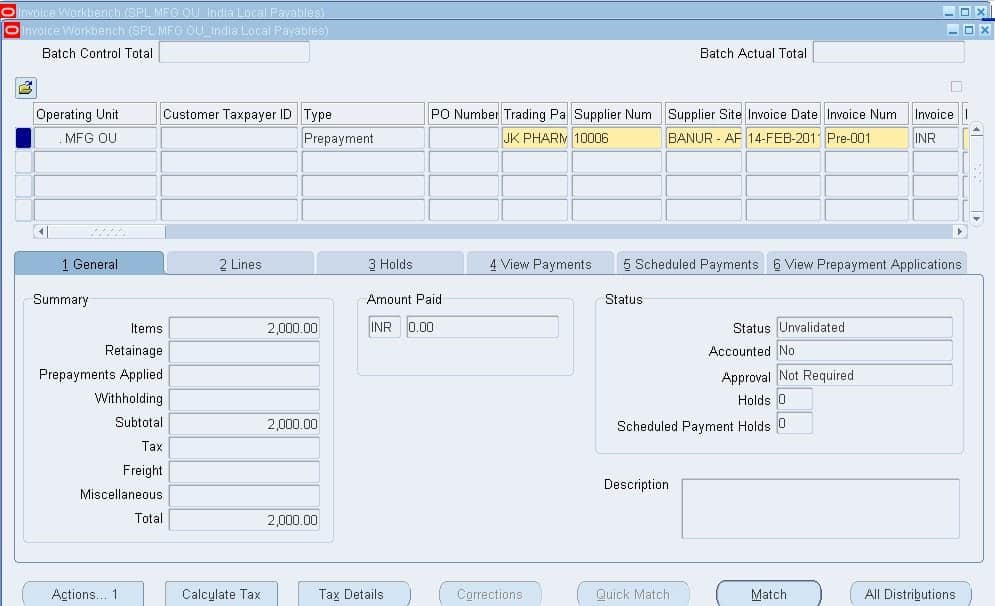

In the Invoice Workbench, you can enter and apply prepayments. You enter a prepayment as you enter any other invoice.

You can also apply a hold to a prepayment if you want to control the payment of it.

Distributions

The prepayment account defined in the supplier site defaults in invoice distribution for a prepayment. We can also enter any number of distributions, either manually, or through distribution sets. We can restrict the prepayment application for a specific purchase order by specifying the Prepayment PO number.

Application of prepayments

You can apply, and pay Temporary prepayments on and after the prepayment settlement date. You can apply only Item distributions from the prepayment. The prepayment remains available until you apply the full amount of the prepayment Item distributions to one or more invoices. You can review the Prepayment Status Report to check the status of all prepayments in Payables.

When you enter a Standard invoice in the Invoice Workbench, or enter an expense report in the Expense Reports window, Payables notifies you if you have available prepayments for the same supplier. You apply prepayments to invoices and expense reports.

When you apply a prepayment, Payables creates a negative amount Prepayment type distribution on the invoice and reduces the prepayment’s available applicable amount. For example, if you apply an INR 10,000 Prepayment distribution to an invoice, Payables creates a negative INR 10,000

Prepayment distribution, and reduces the Amount Available on the prepayment Item distribution by

INR 10,000. The account of the Prepayment distribution on the invoice defaults from the Item distribution on the prepayment.

Foreign Currency Prepayments

If you use accrual basis accounting, Payables uses the prepayment’s original exchange rate when it accounts for the Prepayment distribution on an invoice. This credits the prepaid asset account for the correct amount. Because the prepayment application pays the invoice, Payables then records any gain or loss between the functional currency amount of the payment (original prepayment) and the functional currency amount of the invoice (invoice amount that the prepayment relieved). If the exchange rate accounting causes unequal debits and credits for the transaction, Payables account for that difference in a rounding entry to balance the transaction.

Prepayments against specific Purchase Orders

When we release prepayment by specifying the purchase order against which it is paid in the Prepayment PO number field, we can apply the paid prepayment only against invoices matched against the specific purchase order receipts. To apply any unadjusted advance paid to other invoices, we have to remove the prepayment PO number in the prepayment invoice.

Matching against the Purchase order

Prepayments can also be created by matching it with the purchase order when raised for services or expenses and can be applied against invoices matched against the purchase order.

Procedure

To enter a prepayment:

1. In the Invoices window select Prepayment as the invoice type and enter all basic invoice information. Before entering distributions, proceed with the next three steps.

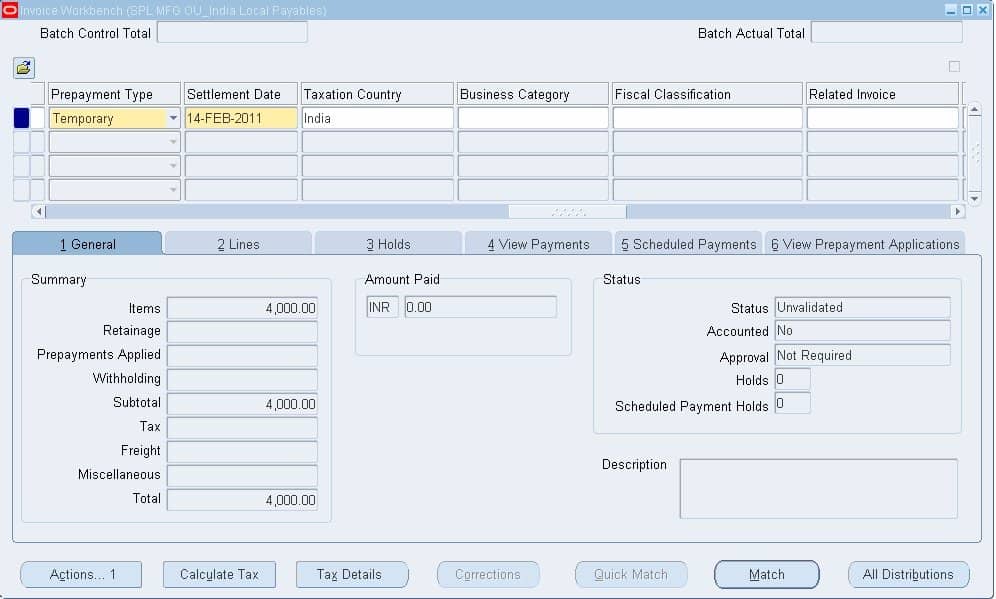

2. Select a Prepayment Type: Temporary/ Permanent

3. The Settlement Date that defaults here is calculated based on your Prepayment Settlement Days Payables option. You can update this value. You cannot apply a Temporary prepayment to invoices or expense reports before the settlement date.

4. If you want to restrict the prepayment application to invoices matched to a particular purchase order, enter a value for Prepayment PO Number.

5. Enter the distributions. You can enter distributions manually or automatically with Distribution Sets and purchase order matching. You cannot manually update distribution line numbers for Prepayment type invoices. If you do not enter distributions automatically, then when you navigate to the Distributions window and enter Item distributions, Payables defaults the prepayment account from the supplier site.

6. Approve the prepayment as you would do any other invoice.

7. Save your work.

The prepayment is ready for payment. You must fully pay prepayments. After you fully pay a Temporary prepayment, it is available to be applied.

When we create a permanent prepayment, it is not available for application against the invoice. At a later, when you want to adjust the permanent prepayment against the invoice, we have to change the prepayment type and save the record.