Define TDS Year Information in Accounts Payable

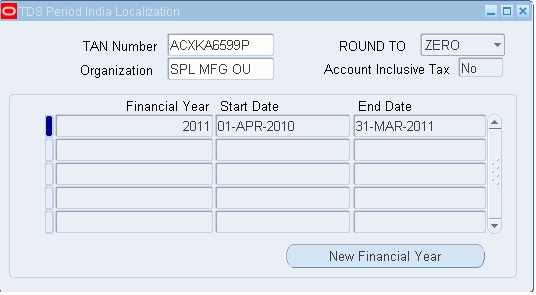

We can use TDS India localization functionality only after TDS year is defined. Once defined it cannot be updated. TDS Year defines the start and end dates of the financial year, as well as the option of rounding off invoices and credit memos issued by the system.

Payable allows us to round off invoice amounts to the closest rupee (Zero) or nearest ten rupees, depending on the TDS year definition choice we choose.

We should open new financial year only when all transactions are completed and certificates are generated for the current year

It is the basis for numbering TDS certificates and determining threshold limitations under the Income Tax Act.

In order to define new financial year-

• Select TAN number & Organization. The financial year information currently defined is displayed.

• Choose ‘New Financial Year’ button. A new row is inserted with start date of new financial year based on end date of the latest financial year defined.

• Enter financial year name and end date and save the record.